Malaysia Residents Income Tax Tables in 2022. How To Pay Your Income Tax In Malaysia.

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Guide To Using LHDN e-Filing To File Your Income Tax.

. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. How Does Monthly Tax Deduction Work In Malaysia.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Donate to Akshaya Patra save tax. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax.

If the taxpayer is required to remit two advance payments on the accrued income tax then the first advance payment is due within a period not exceeding 30 days from the. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Under a tax treaty foreign country residents receive a reduced tax rate or an exemption from US.

Income Tax Reliefs for Tax Residents in Singapore either local or foreign tax-resident. The Foundation is registered under Section 12A a of the Income Tax Act 1961 and is. An incentive on income tax is given for 5 years which is calculated based on a formula.

It may be noted that the total exemption which can be claimed under Section 80GG is much less than the potential exemption for those taxpayers who receive a separate HRA from. Section 80GG of the Income Tax Act provides for this exemption. If gross income exceeded JOD 1 million then the taxpayer is required to remit two advance payments on the accrued income tax using certain rates applied for each tax period.

Overview The United States has income tax treaties with a number of foreign countries. How To Maximise Your Income Tax Refund. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

Find out how much Thailand income tax youll pay when working or retiring here and the deductions and allowances you can claim back. KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the tax initiative said the Ministry of Finance MoF. Donating to an NGO is the best way to gain income tax exemption.

There are virtually millions of. An estimated 50 of Irans GDP was exempt from taxes in FY 2004. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018.

In addition to the 150000 Baht tax exemption threshold persons over the age of 65 receive an exemption on the first 190000 of taxable income. Subject to Inland Revenue Board criteria and guidelines income tax. Even though the progressive rates for personal income tax rates range from zero to 22 percent in Singapore the effective payable tax may come out to be much lower if one takes advantage of the various schemes the Singapore Government has initiated.

This means that if you are aware of a 2022 tax exemption or 2022 tax allowance in Malaysia that you are entitled too BUT it isnt listed here that we dont allow for it in. Tax Offences And Penalties In Malaysia. Our Malaysia Corporate Income Tax Guide.

The complete texts of the following tax treaty documents are available in Adobe PDF format. If the amount exceeds RM6000 further deductions can be made in respect of amount spent for official duties. The deduction will be the lowest amongst.

The Income Tax Act Section 10-13A provides for HRA exemption of tax. Under these treaties residents not necessarily citizens of foreign countries may be eligible to. Income tax on certain income they receive from US.

More on Malaysia income tax 2019. MSC status companies that indulge in high capital intensive dealings can claim a 100 tax exemption on statutory income for 55 years or claim an ITA of 100 QCE against statutory income for 5 years. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

50 of the employee salary is eligible for HRA tax exemption if he or she lives in any of the Metro cities of India. I have closed my tax file in Malaysia when I relocated to. Tax Exemption Limit per year Petrol travel toll allowances.

HRA Tax Exemption for the Salaried Individuals. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Tax Exemption On Rental Income From Residential Houses.

This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. The House Rent Allowances that is given by the employer. According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars.

The maximum amount of exemption which can be claimed under this section at present is Rs. How To File Your Taxes For The First Time. A company or corporate whether resident or not is assessable on income accrued in or derived from Malaysia.

The tax exemption is effective from Jan 1 2022 to Dec 31 2026. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Women who returned to work on or after 27 October 2017 can apply for income tax exemption if they were away from the workforce for at least two years.

While donating towards Akshaya Patra you as an individual or a corporate can claim for a 50 deduction at the time of filing your income tax return. Exemption of import duty and excise duty etc. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Updated Guide On Donations And Gifts Tax Deductions

Lhdn Irb Personal Income Tax Relief 2020

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Personal Tax Relief 2021 L Co Accountants

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Personal Income Tax Guide In Malaysia 2016 Tech Arp

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Malaysia Personal Income Tax 2021 Major Changes Youtube

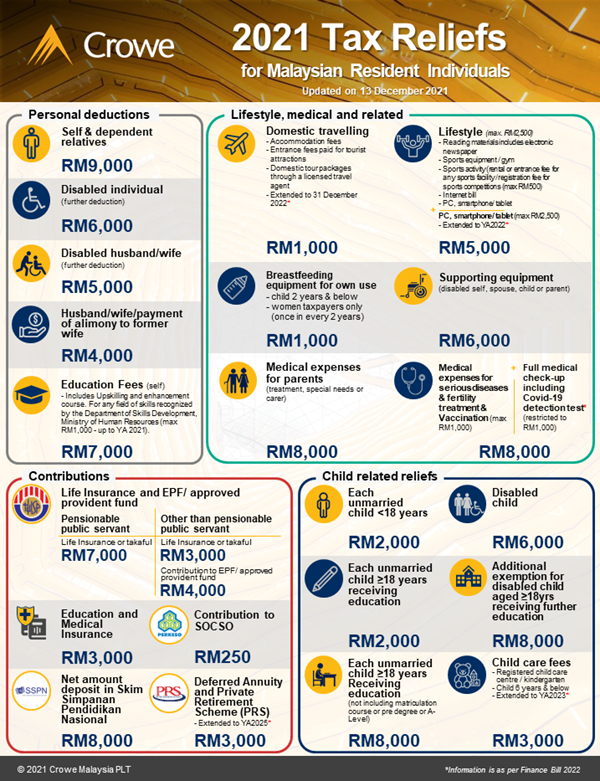

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Income Tax Relief Items For 2020 R Malaysianpf

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia